Welcome to a new series of Air Transformation Lab articles on New Distribution Capability (NDC) adoption.

With Accelya processing 40% of the world’s NDC transactions, we are in a unique position to see the positive impact of distribution and channel management strategy on airline sales. In this first installment, Accelya’s Director of Product Marketing and Programs, Nancy Delgado, and the Air Transformation Lab’s ‘Editor in Chief’, Fearghal O’Connell, explore why now is the best time for an airline to launch its NDC journey.

Watch this space for more articles on NDC adoption, focusing on what strategies are available and how an airline can best manage the change to NDC inside and outside their organization.

Introduction

The airline industry began to get retailing-ready when IATA introduced New Distribution Capability (NDC) in 2012 to give airlines control over offer creation and distribution across all channels.

As part of a new distribution and channel management strategy, NDC gives airlines the freedom to deliver the retailing experiences customers want in their channel of choice, whether that be the airline’s website, app, call center, travel agency, OTA, or via a travel management company (TMC). Once in control over distribution, airlines can also take control over offer creation and order management and unlock the associated benefits of retailing. As such, NDC adoption remains the starting point for most retailing transformations.

While there are many airlines that are making hay with early entry into NDC, there are many more who are just starting out, then there may be some who are still on the fence. Why should your airline double down on its efforts or take the leap? As we see it, there are two major drivers:

- Opportunity

- Ease of adoption

Why NDC? Opportunity

Retailing Value

Distribution freedom has never been more valuable. In a recent report, McKinsey & Co. estimated airline retailing to generate approximately USD$ 40 billion in additional annual value by 2030. This represents an extra 4% of the total industry revenue or $7 per passenger at the end of the decade.

The combination of NDC and retailing is the single most important opportunity airlines have in this period of business recovery. It’s clear that airlines that don’t integrate NDC into their strategy are leaving opportunities on the table.

“Direct access to customers enables us to create and deliver offers tailored to their needs, and we’re in a better position to upsell and cross-sell. That’s where a lot of the value is”, Johannes Walter, Head of Channel Partners, Lufthansa Group.

Control and Agility

NDC gives airlines control of their destiny after years of relinquishing distribution power to others to create and distribute offers. Even though burdened by outdated, monolithic technology, such players were never commercially incentivized to keep up with change. As such, without transformation, airlines struggle to innovate and get new products (e.g., ancillaries and bundles) to market. Even the ‘simplest’ changes can take weeks or months to implement. With NDC and retailing technology, airlines can reduce time-to-market of new products to a matter of weeks.

“Until now, when someone had an idea, we mulled it around and said, “no, that’s going to be really hard to deliver in our current distribution architecture”. We no longer have that concern. Now (with NDC), the world is our oyster when it comes to distributing our products. The exciting part for me is finally being able to rapidly deploy new and innovative products to the market”, George Bryan, Senior Distribution Director, Hawaiian Airlines.

Airlines that don’t break free from legacy will continue to struggle with innovation – and that innovation can come with a little ‘i’. Even if airlines can’t invest in sophisticated strategies such as dynamic bundles or personalized offers, simply being unable to bring a new product to market quickly erodes opportunity.

Richer Indirect Channel

It’s true – since the start of the COVID-19 pandemic, the indirect or agency channel has suffered more than the direct channel, in part driven by the flatlining of business travel. T2RL estimates that the traditional GDS channel accounts for around 19% of passengers boarded compared to around 27% in 2019. But once host direct, tour operators, direct connect and other indirect channels are added, indirect channel volumes in 2021 accounted for approximately 58% of bookings. That’s a lot of customers!

Until NDC, airlines couldn’t sell innovative offers, including ancillaries, to customers buying in the indirect channel, for example from a travel agent. By retailing offers including ancillaries, fare families, bundles, and dynamically priced offers through the indirect channel, airlines can tap into a valuable revenue stream.

Happy Customers

During the pandemic, customer behavior changed – for good. Those caught up in lockdown became more digitally savvy as we picked up new online skills, from supporting school-aged children through online learning to grocery shopping. According to Accelya’s Path to Profitability report, 45% of consumers bought more online in 2020 compared to 2019. As a result, customers have become more digitally demanding. Today’s customers want what other online retailers provide: an easy and seamless ‘shop, buy, and get’ service – wherever they shop. The bad news is that even before the pandemic, travelers perceived the airline digital experience as inferior to those of retailers, banks, and other consumer sectors.

“The pandemic also made everyone go more digital, even shopping for groceries. Currently, most people are doing it online, and we are no longer compared to only another airline, right? So, it’s now everything that they do digitally. So, I think it’s a big challenge. It’s going to be a big push”, Juliana Rios, Chief Information Officer, LATAM Airlines.

The demand for better digital services brings opportunity. The executives we speak to are rethinking how they engage with customers and want to have the customer squarely in mind when making their decisions. As such, we see this period as an industry inflection point, with more airlines embracing the necessary transformation.

“We’ve got customers with experience working with some of the freshest, newest technology. They’re telling us, “Hey, everything else should work this well.” We must keep up with the times and make sure we’re developing tools that customers want to interact with”, Neil Geurin, Managing Director Customer Experience and Distribution Strategy, American Airlines.

Remain Relevant

Today’s environment is fiercely competitive, especially for the leisure market. This is particularly evident by the number of airline new entrants which includes over 40 new airlines that took to the skies in 2021. These newcomers bring with them digital-first strategies, agile retailing readiness, and no legacy baggage.

“When you’re a startup, you can really build your technical and IT infrastructure in a way that you know reduces cost and allows you to react quickly to the environment, especially when it comes to revenue management. It gives you visibility and allows you to move as quickly as you want to move”, Birgir Jónsson, CEO, PLAY Airlines.

Airlines without an NDC and retailing strategy run the risk of losing ground to new or NDC-enabled competitors in the short to medium term.

Why Now? Ease of Adoption

Innovators and Early Adopters

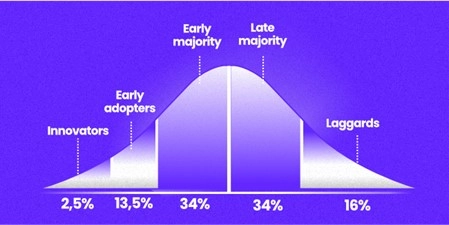

Everett Rogers – Theory of diffusion of innovations

The one-time preserve of market leaders such as Accelya customers, Emirates, Lufthansa Group, and American Airlines, NDC has matured. In 2019, 23 ‘Leaderboard Airlines’ (over 40% of whom were also Accelya customers) committed to having at least 20% of their sales powered by an NDC API by the end of 2020. This goal aimed to cover at least 20% and NDC leaderboard of total IATA passengers carried. If we consider this in the context of Roger’s Diffusion Innovation curve, we can infer that these cohorts as innovators and early adopters.

Introducing new technology is not easy, and typically there are plenty of hurdles to overcome at the start. Our customers came with us on that journey.

Blood, Sweat, and Tears

With necessity the mother of invention, we had to take a nascent version of NDC and supplement shop, book, and service functionality to make it work in the real world. We got tired of waiting for other vendors to come up with complementary solutions such as an agency user interface (UI), so, we built our own. That’s how we roll at Accelya!

We knew that one NDC tool couldn’t cover the whole gambit and what worked for an online travel agency (OTA) may not necessarily work for a Corporate Booking Tool (CBT). The same goes for Passenger Service Systems (PSS). So, we built an NDC Agency UI (then called SPRK) that gives travel agents everything they need to shop, book, and service an offer.

To help third-party developers build services against our customers’ NDC APIs and further the reach of the airlines’ NDC channel, we created a developer program with SDK, documentation, and 24/7 support. We also launched a Preferred Partner Program which calls out the companies that excel at helping airlines distribute their offers with NDC. We built analytics tools that not only monitor the health of an airline’s NDC channel but also help airlines identify and incentivize agencies that are top performers to optimize sales strategy.

The innovators and early adopters are winning as a result. The increasing speed of NDC adoption among these groups is borne out by rising ticket sales. Accelya reported that the number of tickets sold through NDC channels increased by 73% at the end of 2021 compared to 2019. Some airlines are seeing the volume of their transactions in NDC is on par with those done in GDS. And they are seeing the return.

“At the outset, embarking on the journey to retailing early by adopting a strong distribution and channel management strategy involving NDC was an important factor in our current success. It helped us weather the storm and reap benefits along the way”, Johannes Walter, Head of Channel Partners, Lufthansa Group airlines.

The Majorities

Airlines looking to boost their NDC investment or get started on their journey are in a privileged position. They are standing on the shoulders of giants as NDC is mature and entry has never been easier.

Global connectivity is king, and with over 300 travel sellers connected to Accelya’s network, a new airline coming on board will automatically benefit from those existing connections.

When it comes to the implementation, a new NDC-powered airline gets all the onboarding, documentation, and technical support they need to be up and running in the shortest time. A typical NDC implementation can now be completed in a matter of weeks rather than the months it took in the early days.

We have come a long way since the early days and can now accommodate the needs of the majority of airlines.

Conclusion: NDC Has Never Been So Easy

Accelya hasn’t reached the top with a 20% of the NDC market share without its share of blood, sweat, and tears! The thing is that the hard work is done and dusted and adopting NDC has never been easier. With almost 20 airlines in production – NDC is part of Accelya’s DNA, and we’ve been there from the start, shaping, improving, and empowering NDC to play its role in the industry’s retailing transformation.

In the period of pandemic business recovery, every airline benefitted from early transformation and what we learned along the way.

As you can see, the NDC journey wasn’t always straightforward, but considering where that journey has taken us, it was definitely worthwhile. With NDC implementation being so easy after our numerous learnings on this journey, now is a great time for an airline to start its NDC journey.

Contact us to start the conversation and get prepared for your NDC journey.

The next installment in this special series of blogs on NDC will focus on what strategies are available for airlines to increase adoption both inside and outside its organization. Stay tuned for more insights into an airline’s journey to high-performance retailing.