How new generation offer engines can extend the lifecycle of the legacy technology stack while supporting a digital transformation journey.

Traditional airline technology stacks often limit the ability to transform airline commerce. The main reasons for this include:

- Restricted air ancillary merchandising due to static product catalogs and slow time to market for new or enhanced offerings;

- No support for dynamic offers due to static, one-size-fits-all pricing and product definitions, and RBD/Fare Class limitations;

- Lack of control over the offer due to inflexible technology and vendor lock-in.

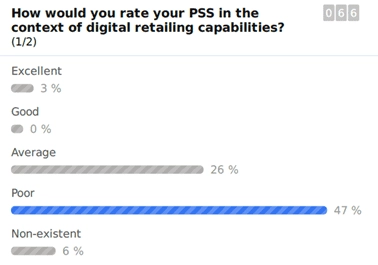

These are also among the reasons why airlines are frustrated with the PSS’ retailing abilities. At the FLX-Disrupt 2018 conference, only 3% of delegates thought their PSS did an ‘excellent’ job at digital retailing, while 47% rated their PSS ‘poor’.

Poll taken at FLX-Disrupt 2018

Beyond technical weakness, there is also the issue of control. Airline commerce needs to own its most valued asset – the offer. The offer is what connects the airline’s products and services to the customer and revenue. How the airline formulates, delivers, and distributes the offer is the airline’s core business, and that control should never be given over to a third-party.

A growing number of airline leaders are scaling back what is asked of existing systems, including PSS providers. Instead, they are choosing to invest in new generation offer engines that the airline can fully control. The airlines that make that investment can embrace digital transformation to meet current and future retailing demands, cost-effectively, and with ease. The airline chooses who will power, not own, the offer.

The challenges airlines have with their PSS are not unique

Wrestling with legacy systems is part of a digital transformation journey. Telecommunications companies, for example, have challenges with their legacy BSS/OSS platforms, including the lack of dynamic product/pricing configurability, functional redundancies, and lack of digital/self-service engagement. Sound familiar? Telcos have been discussing next-generation BSS/OSS for some years, the TM Forum has published the Open Digital Architecture, and proofs of concept have started.

In the airline industry, while the IATA ONE Order program has started the journey to transform legacy PSS data and processes (there are some industry pilots), there is no broad industry push for a next-gen PSS (yet)… Like the next-gen BSS/OSS, the starting point for an eventual move to a next-gen PSS is for the airline industry to look at the PSS as a set of business capabilities, rather than a system provided by a PSS vendor. It became clear at the recent IATA AIRS 2019 in Bangkok that consensus is building for what the capabilities are and how they will support airline retailing.

In the telco industry, this approach has given rise to the so-called Over the Top (OTT) provider. There are many parallels between OTT providers in telco and solution providers in the travel industry. In fact, many airlines are working with OTT-like solutions to support advanced retailing and merchandising. Many retailing capabilities, such as the ability to flexibly create and dynamically price ancillary products, do not have to be provided by a PSS vendor. Airlines can work with the existing legacy PSS backbone while starting to look at the capabilities needed to become a retailer.

What can new generation offer engines do?

By working alongside the existing technology stack, new generation offer engines can fuel the digital transformation of airline commerce by providing:

1. Advanced ancillary merchandising: flexible ancillary product creation, dynamic/personalized bundles, dynamic fare brands

2. Dynamic pricing: Flights and ancillaries

3. Total offer control across all channels

Savvy airline leaders are engaging in such a transformation by partnering with us. Our market-leading offer engines can extend the lifecycle of the PSS. By sitting on top of the backbone of PSS functionality, our offer engines provide the retailing capabilities required to transform and modernize airline commerce.