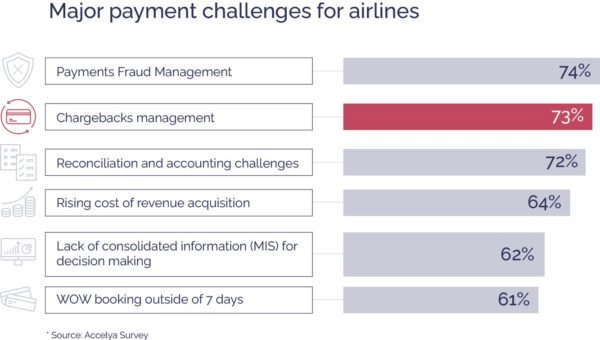

During our last Webinar focused on the impact that COVID-19 is having on airlines, we had the chance to ask our customers about their priorities for payments in these turbulent times.

Chargebacks turned out to be a main priority for our airline customers, and this is aligned with another survey that we carried out, according to which 73% of our airline customers consider Chargeback Management a major challenge.

What is happening with chargebacks during the COVID pandemic?

Card schemes are strongly recommending issuers to resolve disputes with merchants before processing a chargeback. Despite this recommendation, however, we have seen chargebacks increase 800% since the COVID-19 pandemic started.

In an effort to reduce chargebacks, many airlines have implemented varied policies such as vouchers or fee waivers, which are considered reasonable alternatives and are strongly supported by card schemes in this unique situation. Ideally, a friendly agreement should be reached between the cardholder and the merchant to avoid further disputes. As a result, the whole payment cycle would benefit.

Airlines are struggling to manage chargebacks and we are conscious that some fresh ideas can help navigate these tricky times.

Key elements to manage chargebacks effectively

The recent explosion of chargebacks can compromise an airline’s ability to stay in a healthy cash position, so it is important to take care of several key elements that could affect different business areas. At Accelya, we have broken each of these elements down.

Let’s analyze key elements that are inherent to chargebacks handling:

- Automation: It’s key to centralize information, merge claims with each update and respond to chargebacks in an automated way.

- Fraud prevention: It’s important to feed back all the chargeback information to the front-end, so you can prevent fraud automatically. Tracing fraudulent behavior throughout the cycle will give you risk insights and guidance to prevent these types of claims from becoming chargebacks.

- Centralization: A central platform can help connect different systems and avoid confusion coming from individual system particularities. Collecting information from different systems and having all the inputs in just one platform helps improve comprehension. This is especially useful when it comes to leveraging uplift status using Revenue Accounting, Departure Control System inputs or connecting to BSPLink.

- Information gathering: 72% of our airline customers have reconciliation challenges. Incorporating as much info as possible, using alternative sources such as sales, billing and reconciliation is essential to effectively fight back chargebacks.

If you don’t have the ability to change your systems in a short timeframe, having your chargebacks managed externally could be a cost efficient option. Externalization of your chargeback management could lead to several tangible benefits and could help you tackle these areas that are key to the payments ecosystem.

Impact and benefits of a managed chargeback process

Externally managing the chargeback process will help increase recovery rate thanks to faster response time to claims, prioritization, and improved quality of documentation.

Here are some qualitative and quantitative benefits that can come from a managed chargeback process. Below we are analyzing a case study of an airline that has the following characteristics:

- By centralizing and automating replies, this sample airline would be able to respond chargebacks on time and reduce manual errors by 5%, which would mean savings of $500,000.

- By moving from a manual process to an automated platform, the productivity of this airline would increase by 25%, whereas if this airline moved from a manual process to a BPO platform, the increase in productivity could reach up to 40%.

- Duplication of refunded transactions under dispute by the cardholder has increased from 4% to 28% in March 2020 compared to March 2019. This is what we have called “double dipping“ and it would have an economic impact of $7 million for our sample airline. You can learn more about ´´double dipping´´ on our previous payments blog post.

- A better quality response will translate into better win rates. For this airline, the savings coming from a 5% increase in win rates could reach up to $1.25 million.

Although markets are starting to open, we know that the COVID pandemic could bring several waves, which means that the explosion of cancellations and chargebacks won’t fade away anytime soon. The sooner you can put mitigations in place, the easier it will be to deal with subsequent waves efficiently.